What is the Monte Carlo Simulation?

Monte Carlo simulation is a mathematical technique that uses random sampling to model and analyze complex systems. In the fast-paced world of business, decision-making is a critical process that can have a significant impact on the success of a company. Making informed decisions requires access to reliable data and insights, as well as a thorough understanding of potential risks and uncertainties.

A Brief Overview of the Monte Carlo Simulation

The Monte Carlo Simulation was first introduced in the 1940s and was named after the famous Monte Carlo Casino in Monaco, where the roulette wheel provided a model for generating random outcomes. The technique has since been widely adopted in various fields, including physics, engineering, finance, and business.

In simple terms, Monte Carlo simulation involves generating multiple random samples of input data and using them to simulate the behavior of a complex system. The results of these simulations are then analyzed to provide insights into potential outcomes and associated risks.

How Monte Carlo Simulation is Used in Business

Monte Carlo simulation is a versatile tool that can be used in different areas of business. Here are some examples:

Finance: Monte Carlo simulation is commonly used in finance to simulate the potential outcomes of investment portfolios, taking into account factors such as market volatility and uncertainty. It can also be used to calculate the probability of different financial outcomes, such as the likelihood of a certain investment strategy resulting in a certain level of returns.

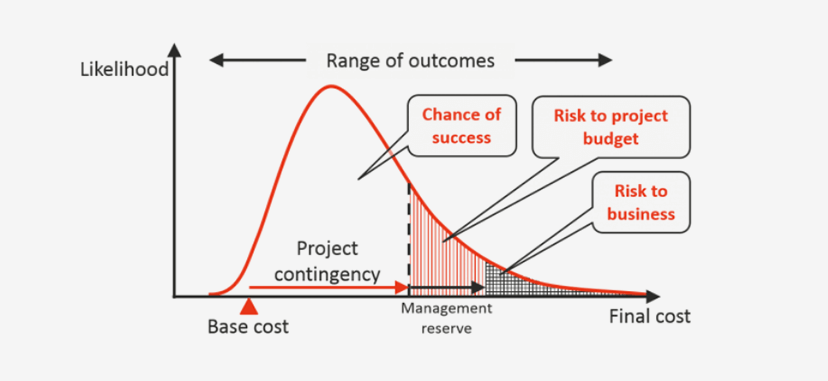

Project Management: Monte Carlo simulation can be used to analyze the potential risks and uncertainties associated with a project. This can help project managers to identify potential issues and develop contingency plans to mitigate those risks.

Supply Chain Management: Monte Carlo simulation can be used to model the potential impact of supply chain disruptions or changes in demand. This can help businesses to identify potential risks and develop strategies to mitigate those risks.

Benefits of Monte Carlo Simulation in Business

Monte Carlo simulation offers several benefits for businesses, including:

Improved Decision-Making: By providing insights into potential outcomes and associated risks, Monte Carlo simulation can help businesses make more informed decisions.

Risk Management: Monte Carlo simulation can help businesses identify and manage potential risks more effectively.

Cost Savings: By identifying potential risks and developing strategies to mitigate them, businesses can avoid costly mistakes and save money in the long run.

Frequently Asked Questions About the Monte Carlo Simulation in Business

What is Monte Carlo simulation and how does it work?

Monte Carlo simulation is a mathematical technique that uses random sampling to model and analyze complex systems. It involves generating multiple random samples of input data and using them to simulate the behavior of a complex system. The results of these simulations are then analyzed to provide insights into potential outcomes and associated risks.

What are the benefits of using Monte Carlo simulation in business decision-making?

The benefits of using Monte Carlo simulation in business decision-making include improved decision-making, better risk management, and cost savings. Monte Carlo simulation provides insights into potential outcomes and associated risks, helping businesses make more informed decisions and develop strategies to achieve their goals.

What are some common applications of Monte Carlo simulation in business?

Some common applications of Monte Carlo simulation in business include finance, project management, and supply chain management. Monte Carlo simulation can be used to simulate potential outcomes, identify potential risks, and develop contingency plans to mitigate those risks.

How can Monte Carlo simulation be used to analyze financial risks?

Monte Carlo simulation can be used to simulate potential financial outcomes, taking into account factors such as market volatility and uncertainty. It can also be used to calculate the probability of different financial outcomes, such as the likelihood of a certain investment strategy resulting in a certain level of returns.

How can Monte Carlo simulation be used in project management?

Monte Carlo simulation can be used in project management to analyze the potential risks and uncertainties associated with a project. This can help project managers identify potential issues and develop contingency plans to mitigate those risks.

Can Monte Carlo simulation help businesses to identify potential supply chain risks?

Yes, Monte Carlo simulation can help businesses identify potential supply chain risks by modeling the potential impact of supply chain disruptions or changes in demand. This can help businesses identify potential risks and develop strategies to mitigate those risks.

How do businesses collect the data needed for Monte Carlo simulation?

Businesses typically collect data from various sources, such as historical data, market data, and customer data. The data is then analyzed and used to generate the random samples needed for Monte Carlo simulation.

Are there any limitations or drawbacks to using Monte Carlo simulation in business decision-making?

One limitation of Monte Carlo simulation is that it can be computationally intensive and time-consuming. Additionally, the accuracy of the results depends on the quality of the input data and assumptions made during the simulation.

Are there any software tools available for performing Monte Carlo simulation?

Yes, there are several software tools available for performing Monte Carlo simulation, such as Excel add-ins, MATLAB, and R.

Can Monte Carlo simulation be used to analyze and optimize complex business processes?

Yes, Monte Carlo simulation can be used to analyze and optimize complex business processes by simulating the behavior of the system and identifying potential areas for improvement.

The Takeaway…

Monte Carlo simulation is a powerful mathematical tool that can help businesses make more informed decisions and manage risks more effectively. By simulating the behavior of complex systems and analyzing potential outcomes and associated risks, businesses can gain valuable insights and develop strategies to achieve their goals. Whether you're in finance, project management, or supply chain management, Monte Carlo simulation can help you make better decisions and achieve better outcomes.